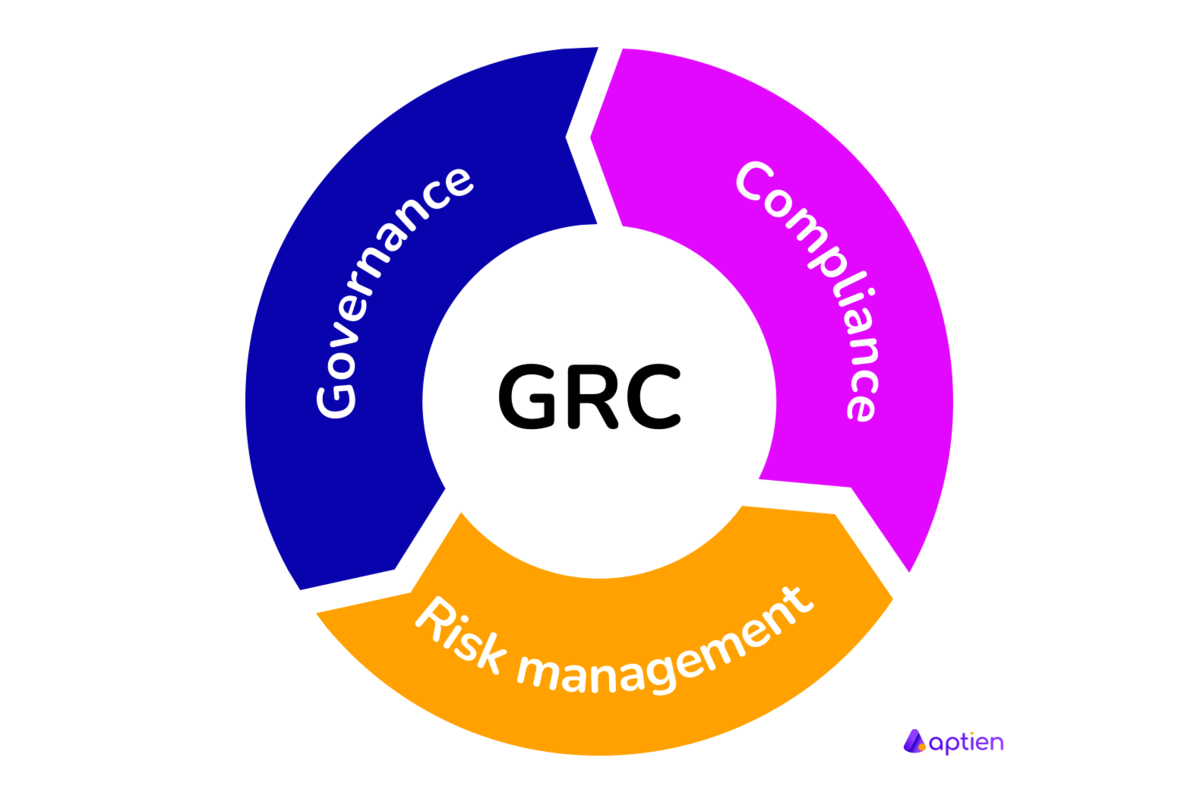

What Is Governance, Risk Management, and Compliance (GRC)?

Governance, risk and compliance (GRC) refers to an integrated set of activities for managing an organization’s overall governance, enterprise risk management and compliance with regulations. GRC enables an organization to reliably achieve goals, address uncertainty, and act with integrity. Think of GRC as a structured approach to aligning processes with business objectives, while effectively managing risk and meeting compliance requirements.

Governance

- Governance is the top level of company management, defines the responsibilities of key stakeholders, such as the board of directors and senior management

- Consists of the set of policies, rules, or frameworks that a company uses to achieve its business goals

Risk management

- Predict potential problems and minimize losses

- Makes sure that any risk, threat or opportunity associated with company assets or activities is identified, addressed and assessed

- Helps businesses identify risks and find ways to remedy any that are found

- Find more about risk management here

Compliance

- Making sure that organizational activities are operated in a way that meets the laws and regulations impacting those systems

- Compliance is the act of following rules, laws, and regulations. It applies to legal and regulatory requirements set by industrial bodies and also to internal corporate policies

- Compliance involves implementing policies and procedures to ensure that business activities comply with the respective regulations

- Find more about compliance here

Impact of GRC on Company Management

- GRC helps companies cut costs, improve efficiency, reduce compliance risks, and improve information sharing.

- GRC means better coordination between company departments.

- This includes the work of departments involved in governance, strategy, risk management, compliance, security, audit, finance, legal, IT, and HR.