Why Should Small and Medium-Sized Businesses Care About Risks?

Small and medium-sized businesses (SMBs) usually have limited resources, so their approach to managing risks needs to be straightforward and practical. Just because a business doesn’t have a formal risk management plan doesn’t mean it isn’t handling risks in some way. Risk management shouldn’t be a paperwork-heavy process done just for the sake of it. It’s a natural part of protecting your business and making sure it can keep running.

What Are Risks and Risk Management, Simply Put:

- Risks are potential issues that could affect your business.

- You want to avoid these issues or be ready to handle them if they happen.

Focus on the Biggest Issues

- Problems can be small or big.

- Big problems (risks) can threaten your business operations or the safety of your employees.

- A major issue could also be not following laws or regulations, which can result in costly fines.

- You should address big problems by eliminating the cause, transferring the risk (like through insurance), or reducing their impact.

- If you ignore them, these problems usually won’t just go away.

- Minor problems can be accepted as part of doing business (this means taking the risk).

How to Manage Risks in Small and Growing Businesses?

Risk management might seem complicated, but for small and medium-sized businesses, it comes down to three simple steps:

1. What Risks Do You Face?

- Identifying risks means spotting potential problems or threats that could affect your business. These risks can be small or significant.

2. How to Handle Those Potential Problems?

- For each risk you identify, decide how you’ll respond.

- You might choose to accept the risk—meaning you do nothing but are prepared to deal with it if it happens.

- Or you can reduce the risk, transfer it to someone else (like through insurance), or eliminate the risk completely.

3. What’s the Outcome?

- Ideally, you’ll have identified and planned for risks, leaving you with minor, manageable issues your business can handle.

- Without proper planning, you could face major problems and just hope they don’t happen.

1. Risk Analysis and Assessment

- Risks are potential issues that may or may not occur.

- Start by identifying potential threats that could seriously impact your business operations.

- Focus on risks that could jeopardize your business, lead to significant financial losses, or result in penalties.

- Think of it this way: "If this happens, do we have a major problem?"

- Assess the potential impact of each risk, from "we can manage it" to "it would shut us down."

- Risks should be identified by management or the business owner, as they are most familiar with potential issues.

2. How to Handle Future Issues

After identifying potential issues, you need to decide how to manage each one. What are your options? The best strategy is to prevent problems before they happen.

- Do nothing = the problem continues

- Eliminate the source of risk = the problem is resolved

- Shift the risk to someone else = another party manages the problem

- Reduce the risk to an acceptable level = the problem becomes manageable

- For every issue, have a clear plan for how to fix it and how to respond if it arises

3. What's the Outcome of Risk Management? Manageable Problems!

Risks are a natural part of running a business, and issues will come up. It’s not a matter of if, but when. The key is being prepared to handle them. Ideally, your risk management efforts lead to smaller, manageable problems that your team can quickly fix. Sometimes, though, you may find a risk that you can’t avoid or fix—maybe because of budget constraints or limited resources—or a problem that’s completely out of your control. In those cases, you face a bigger challenge and have to hope it doesn’t happen. You’ll need to accept that risk. If that’s the situation, at least have a backup plan or a clear idea of what you’ll do if the problem does occur.

How to Handle Problems?

The best way to deal with problems is to prevent them before they happen. But if a problem does arise, it’s important to have a clear plan to fix it and respond appropriately.

How to Prevent Problems

By managing risks, you can often avoid problems altogether—either by eliminating the cause or passing the risk to someone else. These are the best-case scenarios. To reduce risk, prevention is key. This can be done through technical solutions (like installing non-slip flooring to prevent falls) or through people-focused actions such as training and improving processes (for example, following proper procedures for handling hazardous materials to avoid injuries).

- Technical Solutions

- Employee Training

- Process Improvements

How to Respond to Problems When They Occur

If a problem happens, you should have a plan ready to address it quickly and effectively. This means having steps in place to resolve the issue and to restore normal operations as fast and smoothly as possible.

Sharing Company Risk Information

Sharing this information isn't just red tape – it helps a business better withstand and respond to challenges and crises. It's therefore crucial for small and medium-sized businesses (SMBs), not just large corporations. Even in a small company, poor communication and lack of information sharing can be the primary reason for failing to prevent or effectively manage issues (e.g., a cybersecurity breach, equipment breakdown, or employee injury). SMBs are increasingly taking risk management more seriously, often driven by demands from customers, insurance providers, compliance requirements, and a growing understanding of their own vulnerabilities.

Why Sharing Information is Important

- Supports Audits and Insurance – Well-maintained documentation and an overview of implemented safeguards increase the company's trustworthiness.

- Avoid Repeating Mistakes – Shared information about past issues helps learn and avoid making the same mistake twice.

- Reduce Wasted Time and Effort – If people in the company share information about emerging problems in an unorganized way, it leads to a lot of wasted time and duplicate efforts.

- Increase Employee Engagement – When people see that risks are being shared and addressed, they are more likely to get involved.

How to Manage Risk Information Sharing in a Medium-Sized Company?

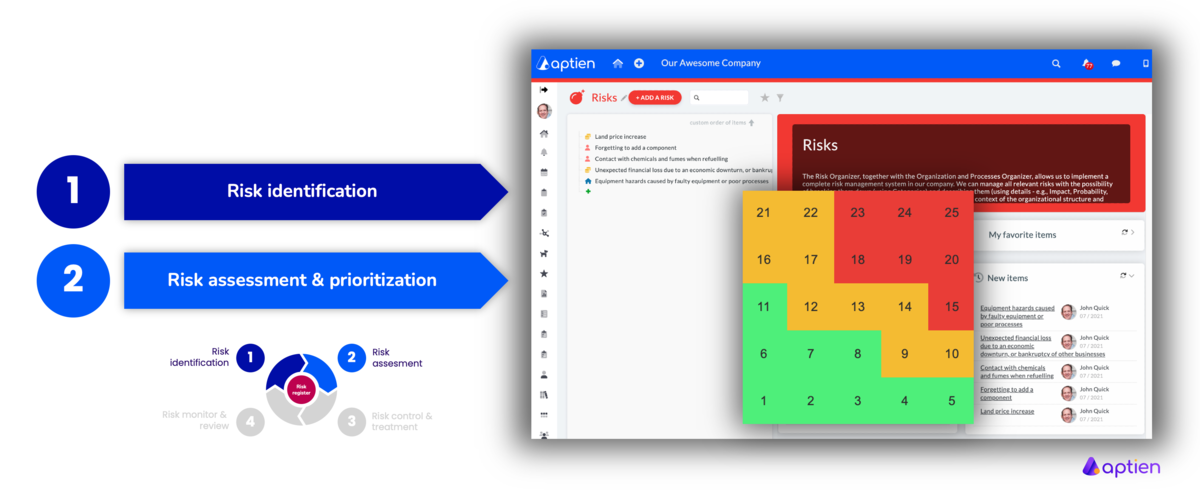

You can manage everything manually, on paper, spreadsheets, or via email. If the company is larger and the overall business environment is more complex, relying on email threads or spreadsheet 'ping-pong' will often create more headaches than help. Sharing and communication become simpler when using a dedicated application to track risks, their origins, discussions about mitigating them, the actions you're taking, and more.

- A risk register will help you share and communicate the list of risks across the company.

- It's therefore important to know where to start and how to proceed with setting it up.

Overview of Risks, Risk Sources, and Problems

- List of identified risks: To increase awareness of what threatens the company and where the vulnerabilities are.

- It's useful to have information about the sources of risks, whether they stem from your assets or business processes.

Coordinating Measures

- Measures that help you reduce risks

- Implemented and Planned Actions: To make it clear who is responsible for what, and to prevent duplicate efforts or critical oversights.

- Risk Management Tasks: For an overview of responsibilities, deadlines, and progress.

- Findings from audits or inspections: Enable tracking compliance status and required corrective actions.

Reporting Problems and Incidents

- Various incidents, deviations, accidents, near misses

- Clear procedure and responsibilities for incident resolution

- Often required by regulations, especially crucial for businesses in heavily regulated sectors.

- For learning and preventing further occurrences.

Employee Training and Awareness

- For employees to know what is expected of them and how to behave, they must understand company policies, rules, and operating procedures

Our Recommendations for a Medium-Sized Business

- Use a simple, centralized platform (like Aptien) to track potential issues, actions taken, and who is responsible for each task.

- Keep sensitive information separate by department—for example, the IT team doesn’t need access to HR issues, and vice versa.

- Schedule regular updates and meetings (such as quarterly security reviews or incident debriefs) to stay on top of any problems.

- Encourage employees to participate by making it easy to report issues or near misses using a form or app.

Summary of Terms:

- Risks (possible problems or threats),

- Actions (steps taken to address the issue),

- Incidents (events that happened or almost happened),

- Tasks (assignments given to team members).