Definition of Critical Assets

Critical assets are essential business assets required for the fundamental operations of an organization. Their damage or loss can lead to operational paralysis and have severe consequences for the organization. Understanding these assets is crucial for risk management, as it helps identify what is operationally critical to the business.

Examples of Critical Assets

A critical asset can be any business resource or asset - both tangible and intangible business assets, for example:

- Real Estate: Buildings and land owned by the business.

- Machinery and Equipment: Technologies, Tools and machines.

- Inventory: Goods and materials held for sale or production.

- Cash: Liquid funds available for immediate use.

- Information Assets: Information and data crucial for business operations.

- Employee Know-How: Skills and knowledge possessed by employees.

- Intellectual Property: Patents, trademarks, and copyrights.

How to determine which assets are critical for your business

- Asset criticality is based on how essential an asset (system, equipment, document, software, person) is to daily business operations.

- The simplest approach is to assess the impact on operations if the asset is unavailable, lost, damaged, or otherwise impaired.

A simple set of questions for SMBs to assess asset criticality

- Business impact: What happens if the asset goes down? (operations halt, data loss, customer impact, or just a minor inconvenience?)

- Recoverability/Redundancy: How quickly can the asset be restored or replaced? (backups, vendor SLA/support, spare equipment, cloud failover)

- Financial impact: What direct and indirect costs arise? (lost revenue, rush fees, overtime, contractual penalties, repair/replacement)

- Regulatory/Compliance impact: Is the asset tied to data privacy, workplace safety, industry standards, or other legal obligations?

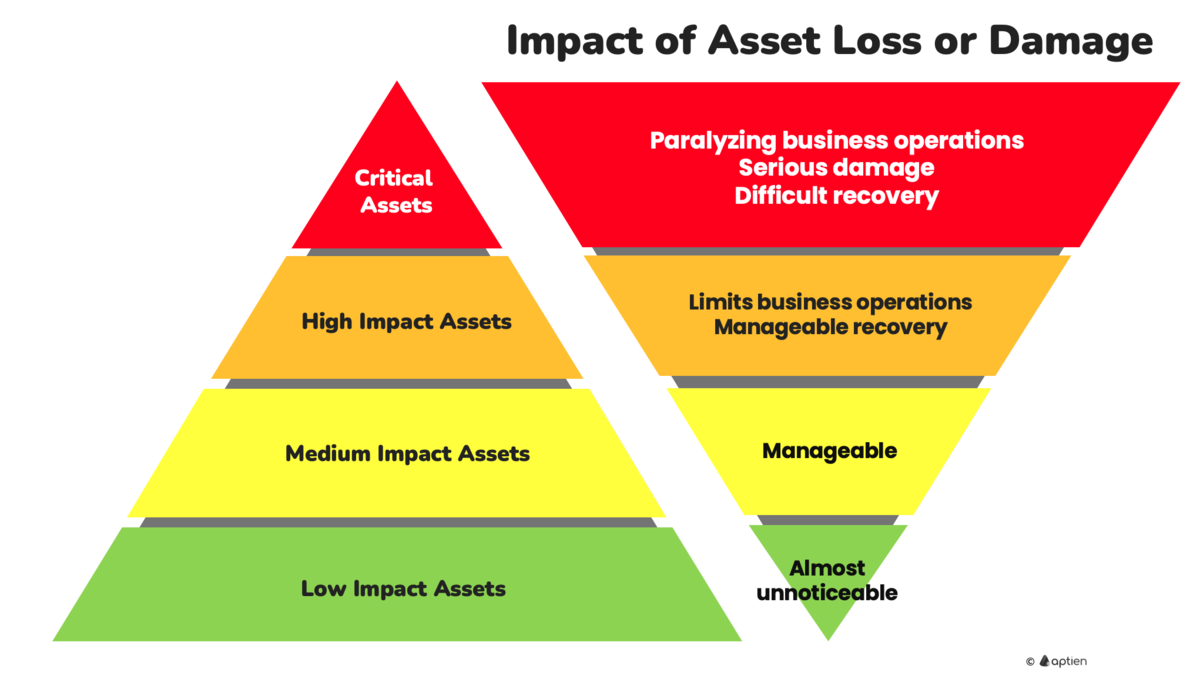

How to rate criticality: a practical approach for SMBs

- You can use different scales, such as 3, 4, or 5 levels.

- Criticality assessment should be practical, simple, and clear. For small and midsize businesses, a 3-level scale (Critical / Important / Low) based on impact on operations, finances, and compliance is usually sufficient.

- This gives SMBs a clear basis for planning backups, support contracts, preventive maintenance, and capital or IT investments.

What does a 3-level criticality scale look like?

- Critical – the business cannot operate without these (accounting/ERP system, production machinery, payment processing, core company data).

- Important – some operations are disrupted, but the business continues (CRM, internal knowledge base/wiki, key workstations or laptops, some equipment).

- Low – downtime is inconvenient but does not threaten operations (breakroom coffee machine, office decor, non-essential peripherals).

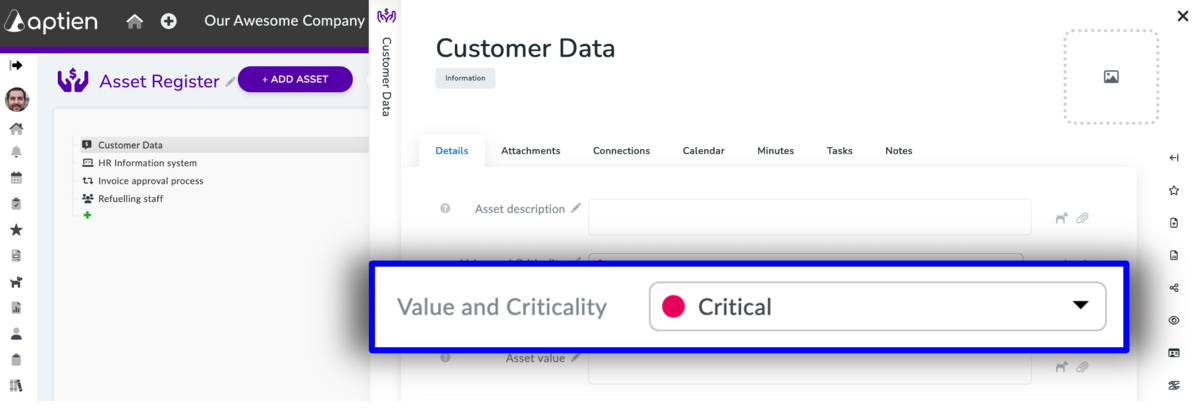

How to assess and manage critical assets

- Open the Asset Register

- Add a new asset or select an existing one

- Set the asset’s value

- Enter your organization’s business value for this critical asset; this will be the basis for your risk assessment

- Select risks associated with the critical asset

How to Identify and Manage Critical Assets: A Simple Guide

Step 1: List Your Critical Assets

- Make a list of critical assets: Ask, “If we lose this, will operations stop or customers be impacted?” Identify your top 10 critical assets (equipment, key employees, facilities, hardware, software, data, and processes).

Step 2: Confirm What’s Truly Critical

- If everything on the list is clearly critical, you can skip detailed scoring.

- You can also tag some assets as “important” (not critical) to tighten the list.

Step 3. Assign Accountable Owners

- Assign an asset owner—someone accountable for the asset and for confirming its criticality.

Step 4: Reduce Risk and Prevent Downtime

- Set up workarounds or documented procedures to avoid single points of failure.

- Create backup and recovery plans (how to restore service fast).

- Use standard operating procedures (SOPs) to reduce risk.

- Adopt tools and controls that help mitigate risk.

You can’t effectively manage this in Excel.

- Share status and ownership in Aptien so responsible people can take action.

- Policies and SOPs reduce dependency on individual people.

- Prepare for incidents and crises (know who does what and when).

- Link safeguards—ensure backups, disaster recovery plans, and support/maintenance agreements for critical assets.